As the electric vehicle (EV) market surges in the United States, the nation’s charging infrastructure is undergoing rapid expansion. While the number of EV chargers has grown significantly, the question remains: Are we on track to meet future demand? Here’s a closer look at the current landscape of EV charging stations in the US, along with the projected requirements to support a booming EV market by 2030.

Current Status of EV Chargers in the US

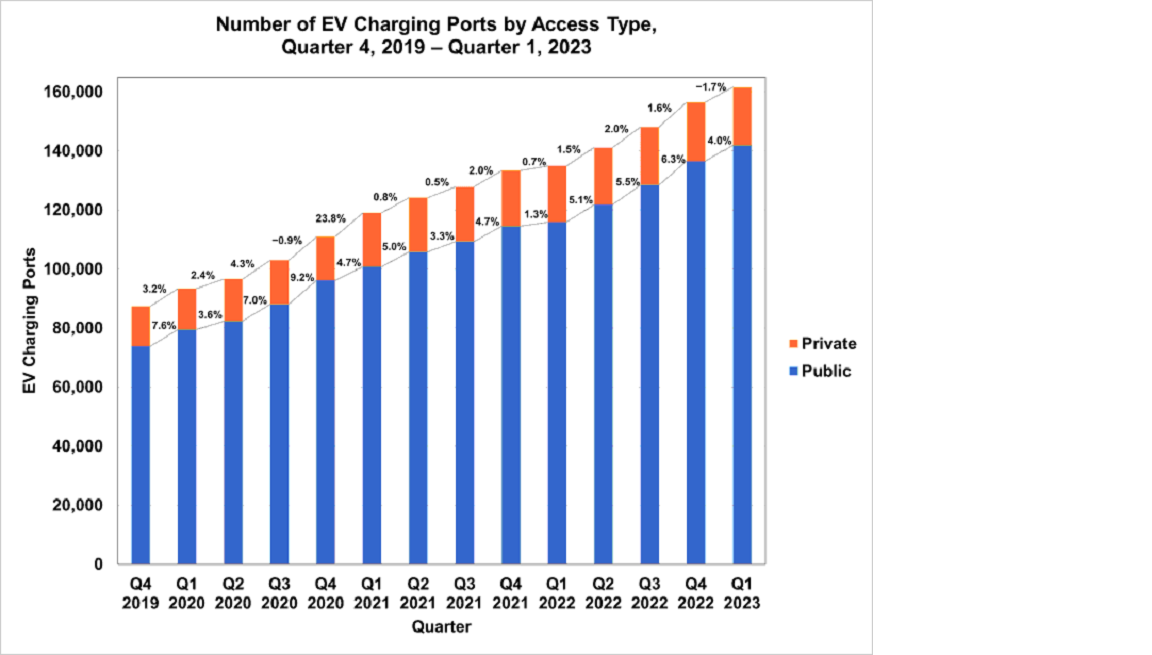

As of the most recent data, there are approximately 163,753 EV charging ports spread across the United States. This includes a mix of Level 2 and Level 3 chargers, which cater to different charging speeds and use cases:

⦁ Tesla Superchargers & Destination Chargers: ~17,000 chargers, primarily catering to Tesla’s extensive and growing fleet.

⦁ Public Level 2 Chargers: ~126,500 ports, offering charging options at a moderate speed, ideal for locations where vehicles are parked for extended periods, such as workplaces, shopping centers, and residential areas.

⦁ Public Level 3 Chargers (DC Fast Chargers): ~20,400 ports, designed for quick top-ups, making them crucial for long-distance travel and reducing range anxiety.

This surge in charger numbers marks a significant increase compared to previous years. For example, 2022 alone saw the addition of approximately 54,000 Level 2 and 10,000 Level 3 chargers, surpassing the combined total of the preceding three years.

The Growing Demand for EV Charging Infrastructure

As of October 2022, around 1.9 million EVs are on US roads, representing 0.7% of the total 281 million vehicles in operation. However, EV adoption is accelerating, with new EV registrations accounting for 5.2% of all light-vehicle registrations in the first ten months of 2022. This growth is being driven by several key factors:

⦁ Consumer Demand: Rising fuel costs and increased environmental awareness are pushing more consumers towards EVs.

⦁ Government Policies: Federal incentives like those in the Inflation Reduction Act are making EVs more accessible to the average consumer.

⦁ Investment from the Financial Sector: Increased investment in EV technology and infrastructure from private companies is further accelerating growth.

Looking forward, it’s estimated that EV market share for new vehicles could reach 40% by 2030, translating to around 28.3 million EVs on US roads by the end of the decade. This rapid increase in EV adoption will necessitate a corresponding expansion in charging infrastructure.

Florida and Texas: These states, despite differing in their approach to emi

Projected EV Charger Requirements by 2030

To accommodate the expected growth in EV numbers, the United States will need to significantly expand its charging network. Current estimates suggest that by 2030, the country will require:

⦁ 700,000 Level 2 Chargers: These chargers will primarily support everyday use, providing a reliable way for EV owners to charge their vehicles during longer stops, such as at work or shopping centers.

⦁ 70,000 Level 3 Chargers: As the backbone of long-distance travel, these chargers will be critical for reducing range anxiety and supporting the expected surge in road trips by EV owners.

This means that the number of chargers will need to grow more than eight-fold by 2030, even when considering the impact of home charging. By 2027, it’s anticipated that the US will need around 1.2 million Level 2 chargers and 109,000 Level 3 chargers to keep up with demand. Looking further ahead to 2030, the numbers increase to approximately 2.13 million Level 2 and 172,000 Level 3 public chargers.

Federal and State Initiatives: Fueling the Expansion

In response to the growing need for charging infrastructure, the US government has launched several initiatives. One of the most significant is the National Electric Vehicle Infrastructure (NEVI) formula program, part of the Bipartisan Infrastructure Law. This program has allocated $5 billion over five years to develop EV charging infrastructure across all 50 states, Washington, DC, and Puerto Rico. The goal is to create a network of 500,000 publicly accessible chargers by the end of 2030.

States like California, Florida, Texas, and New York are leading the way due to their large EV markets. For instance:

⦁ California: With nearly 37% of all EVs in operation, California also accounts for 36% of new EV registrations. The state has ambitious goals to expand its already substantial charging network, focusing on both urban and rural areas.

⦁ sessions reduction, are seeing rapid growth in EV adoption. Florida has around 7.4% of the nation’s EV registrations, while Texas follows closely with 6.4%.

For example, Texas currently has around 5,600 Level 2 and 900 Level 3 chargers. However, by 2027, it will need 87,500 Level 2 and 7,800 Level 3 chargers to support an estimated 1.1 million EVs on its roads.

The Urban vs. Rural Divide in Charger Distribution

Currently, 85% of Level 3 chargers and 89% of Level 2 chargers are located in 384 Metropolitan Statistical Areas (MSAs), highlighting a significant urban concentration. Tesla’s chargers are similarly concentrated, with 82% of Superchargers and 83% of destination chargers located in MSAs.

This urban focus aligns with where most EVs are today, but as the EV market grows, the distribution of chargers will need to expand into rural areas to ensure comprehensive coverage. Analysts predict that to achieve mass-market acceptance of battery electric vehicles (BEVs), the charging infrastructure must not only keep pace with sales but also exceed expectations. This will involve:

⦁ Wider Distribution: Extending the charging network to rural areas to ensure all drivers have access, no matter where they are.

⦁ Enhanced User Experience: Improving the convenience and reliability of chargers, making the experience as seamless as possible.

Looking Forward: Challenges and Opportunities

The rapid expansion of the EV charging network presents both challenges and opportunities. The key will be to balance the pace of infrastructure development with the rising number of EVs on the road. Strategic placement of chargers, particularly DC fast chargers, will be crucial. For example, ensuring that fast chargers are available in well-lit, accessible locations like interstate rest stops can significantly enhance the convenience of long-distance EV travel.

Moreover, the future of EV charging will also involve addressing the needs of a diverse user base. While home charging will remain the primary option for many, the expansion of public chargers will be essential for renters, travelers, and those without access to home charging.

Conclusion

As the US marches towards an electric future, the expansion of EV charging infrastructure will be critical to support the anticipated growth in EV ownership. The task ahead is monumental: expanding the current network eight-fold by 2030. However, with federal support, state-level initiatives, and strategic private investment, the nation is on track to meet this challenge head-on, ensuring that the transition to electric vehicles is not only possible but convenient for all.

Authored by Frank A. Forelli at EV Charging Solutions LLC